South Carolina Solar Tax Credit 2017

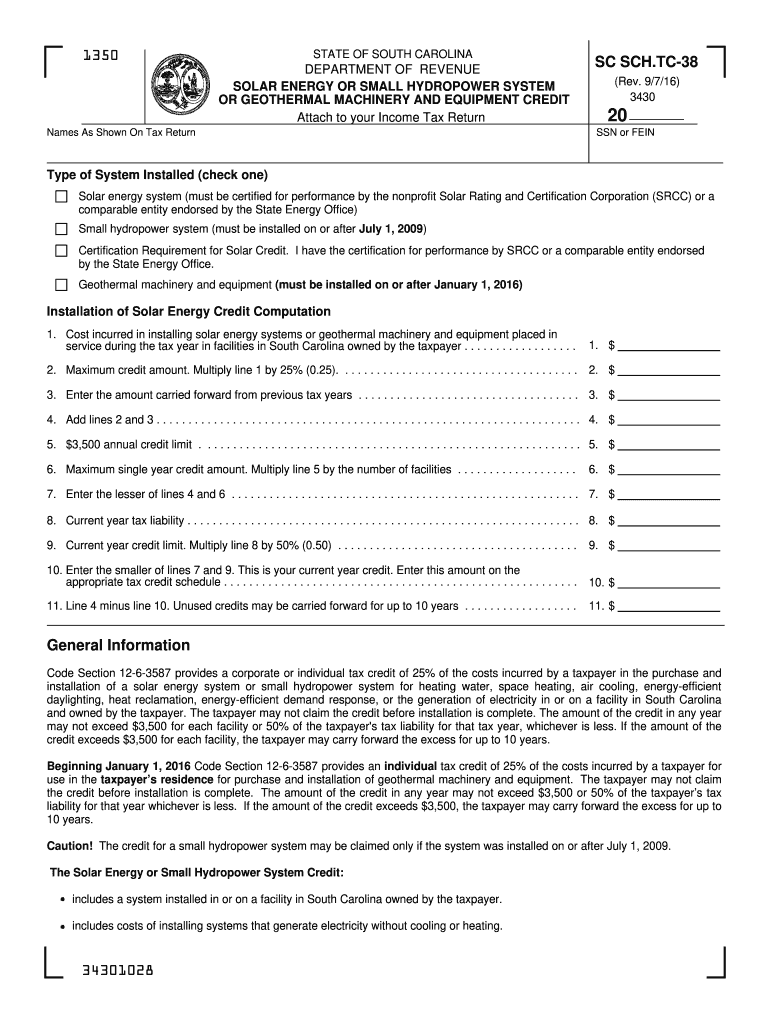

Residents of the palmetto state can claim 25 percent of their solar costs as a tax credit and if you don t pay enough in taxes to get the full value of the credit in one year it.

South carolina solar tax credit 2017. South carolina s tax credits may be earned by individuals c corporations s corporations partnerships sole proprietors and limited liability companies. 25 of total system cost up to 35 000. South carolina department of revenue po box 125 columbia sc 29214 0825. Sc solar energy system credit.

Solar energy property credit. Credits are usually used to offset corporate income tax or individual income tax. Application for solar energy property credit. Cut the cost of installing solar on your home by a quarter with south carolina s state tax credit for solar energy.

25 south carolina tax credit for solar energy systems. South carolina solar energy tax credit. Application for clean energy credit. Credits may be disallowed if necessary schedules are not attached to your.

In july 2009 south carolina passed its solar rebate tax incentive law to allow homeowners in the state to claim credits for any renewable energy systems that they installed in their homes. Can only take 3 500 or 50 of your tax liability per year for up to 10 years. The state of south carolina offers an additional tax credit for home and business owners who go solar worth 25 of the total cost including installation. State of south carolina department of revenue 2017 tax credits name your social security number credit description code amount most of these credits are computed on separate forms.

In order to qualify for the credit the solar energy property must be located in south carolina placed in service in this state during the taxable year and be located on. The epa s national priority list equivalent sites. Electricity in or on a facility in south carolina can claim an income tax credit of 25 of the cost of purchasing and installing that system. A tax credit is an amount of money that can be used to offset your tax liability.

The environmental protection agency s epa national priority list 2. Taxcredits dor sc gov angel investor credit parental refundable credit and education donor nonrefundable credit. Attach the appropriate credit form s and or sc1040tc worksheet to the sc1040tc and sc1040. The credit for a small hydropower system may be claimed only if the system was installed on or after july 1 2009.

Credits are fully claimed. General tax credit questions.